- October: CMRA Annual Summit

On October 23rd and 24th, CMRA (China Marketing Research Association) held their 8th China’s Marketing and Market Research Summit in Shanghai with nearly 450 in attendance. The theme of this year’s Summit was “Integration and Symbiosis”. “Integration” means integrating industry resources and optimizing industry service structure; “symbiosis” means mutual benefit and symbiosis with customers, deepening the industrial chain and building a harmonious ecosystem of the industry. The summit invited experts from the government statistics department, famous domestic sociologists, economists, marketing experts, academics, professors, corporate clients and representatives, and international and domestic experts and practitioners in the market research industry. (Excerpt from CMRA website)

Jane Zhang from SSRI CHINA was one of the experts at the Summit and did a presentation about how to better understand the healthcare market by utilizing and integrating / combining various resources and methods, such as secondary data, large scale market research data and ad-hoc research. She spoke about the four key aspects in which we consider to be important in understanding the market – market size, market concentration, unmet medical needs and sales rep coverage.

For market size, she used diabetes as an example, and compared the data from a nationally representative survey on diabetes (which suggest that there are 47.75 million diabetes patients undergoing treatment) with the estimated number of diabetes patients from PatiensMap (48.1 million) and mentioned the importance of comparing several data sources to get a more accurate picture of the market size. For market concentration, unmet medical needs and sales rep coverage, she mentioned the importance of utilizing large scale research data such as PatientsMap data as basic information to better assess the validity of the client’s assumptions and/or their prior knowledge, better design ad-hoc market research, to determine the efficiency of budget management (e.g. R&D and sales rep allocation), and to better understand the outcomes of ad-hoc market research.

The transcript to her presentation can be found in the CMRA website (Chinese only);

http://www.cmra.org.cn/newsshow.php?id=531

SSRI CHINA news

2019 << Top >> 20172018

- August: Inside China 2018 Seminar (in Tokyo)

SSRI, along with SSRI China and SSRI Asia Pacific held a seminar “Inside China 2018” on August 3rd, 2018 in Tokyo to approx. 40 people from 23 pharmaceutical and medical device companies. The seminar consisted of presentations about the 2nd largest pharmaceutical market in the world, China, from the point of view of physicians, patients and the research agency. In addition, Qing-Kun Song, an associate professor at Beijing Shijitan Hospital (affiliated to Capital Medical University, Department of Science and Technology, Cancer Epidemiology division) gave a special presentation on China’s cancer epidemiology and the social background surrounding the Chinese healthcare system. The summary of each presentation as follows:

Cancer epidemiology in China – special presentation by Qing-Kun Song of Beijing Shijitan Hospital

~ Innovative new medicine – opportunity for Japanese manufacturers ~

The results from 10 years of various cancer screening projects in China showed that the current cancer prevention and treatment systems in China are insufficient. Compared to the cancer prevention and treatment situations in Japan, early detection of cancer is insufficient and the treatments are non-standardized. In addition, there are issues of lower survival rates and side effects because conventional chemotherapy and radiation therapy are still widely used due to the fact that many new therapies are not available in China.

For this reason, the Chinese authority is in a “welcoming” mood for importing/ approving innovative new medicines from overseas, and has stated that they are willing to accept oversea clinical data upon approving new medicines. Since Asian (Japanese) clinical data is likely to work more favorable (easier acceptance) compared to Western clinical data, now may be a good time for Japanese manufacturers to consider entering into the Chinese cancer market.

Basic information on the Chinese pharmaceutical market (by Jane)

~ Patients are highly concentrated in tier 3 hospitals ~

The land mass of China is approx. 25 times of Japan with significant regional differences. Of the approx. 980,000 healthcare institutions in China, the vast majority are institutions at the grassroots level such as village clinics that can only administer vaccines and treat very mild sicknesses. Hospitals that offer more comprehensive care only occupy 3% of the entire healthcare institutions in China. These hospitals are categorized into 3 tiers based on hospital infrastructure, level of care, the number of specialists etc. Of these hospitals, the top ranked tier 3 hospitals only occupy 8% of all hospitals, but see more than half of the outpatients who visit hospitals. While China operates under a universal health insurance system, the unique characteristic is that there is a maximum ceiling on the reimbursable amount.

Market research in China (by Kio)

~ Need to consider the unique cultural / social characteristics ~

Upon conducting market research in China, it is important to consider the influence of Confucianism and the “face” culture. Focus groups will often not give you the truth and tendency of high average scores etc. are characteristics to be considered upon designing the study and analyzing the results in China. Also, it is important to know that doctors are very keen on the cost of medicine since new products will not be reimbursable in China, and there is a ceiling on health insurance coverage. Lastly, it is important to remember that the doctor-patient relationship in China is very poor. Violence against doctors in China is quite common and doctors may select treatments and tests in order to “protect” themselves rather than for the benefit of the patient. Knowing and not knowing these unique characteristics of China will have a big difference upon comprehending the market research results from China.

Disease management and new Tx needs (from Chinese physician research data; PatientsMap)

~ Significant market size for respiratory, chronic diseases and cancer ~

SSRI and M3 recently launched PatientMap 2018 China with research data from over 10,000 Chinese physicians. According to this database, respiratory conditions such as upper and lower respiratory infections, COPD and pneumonia, and lifestyle diseases such as hypertension, type 2 diabetes and dyslipidemia occupied the top estimated number of patients in China. The data suggested that there are 61 million hypertension patients currently being treated in China. For the estimated number of cancer patients, stomach cancer and NSCLC each showed 2.1 million in China vs. 0.3 and 0.19 million respectively in Japan, followed by colorectal cancer at 1.8 million (0.34 million for Japan). For diseases/conditions in which physicians wish for new products (unmet needs), hematological malignancies such as AML and ALL, and psychiatric conditions such as schizophrenia and bipolar disorder were amongst the top diseases/conditions. PatientsMap is a large-scale database product developed by SSRI and M3 in collaboration which contains physician research data on the number of patients they see for around 400 diseases/conditions (including rare diseases).

Characteristics of general population and patients in China (from NHWS data)

~Increase of OCT/TCM usage under government promotion, but still high demands for branded Rx ~

According to NHWS, a patient-reported outcomes (PRO) data, the migraine market in the urban cities, including undiagnosed patients, exceeds 60 million. Of these 60 million, more than half are undiagnosed, which is double or more the number of Japan and the US. Comparing the migraine/pain data from 2010/2011 and 2017, while the overall treatment rate has increased more compared to Japan and the US, the usage of OTC including TCM has increased to around 70%, which is quite unique to China. However, when comparing the disease severity, treatment usage and satisfaction, it showed that Rx was more preferred than OTC, and there was a tendency of preferring branded medications over generics. NHWS is a patient database product developed by Kantar Health covering over 165 diseases/conditions in 10 different countries. (NHWS is being sold in Japan by SSRI)

_______________________________________

■ Contact information

Regarding the seminar: Jane Zhang (zhangjun@ssrichina.com)

Regarding market research in China:

Pharma clients: Ryusuke Shinozaki (shinozaki@ssri.com)

Agency clients: Kio Tsuzaki (ktsuzaki@ssri.com)

Regarding PatientsMap: Ryuichi Kayano (rkayano@ssri.com)

Regarding NHWS: Sachiko Funabashi (sfunabashi@ssri.com)

■ Social Survey Research Information Co., Ltd

Established: April 1982

Capital: 27 million yen

Executive: President & CEO Takashi Makita

Staff: 140

Address NMF Shinjuku EAST Bldg. 10-5 Tomihisacho, Shinjuku-ku, Tokyo 162-0067 Japan

Osaka Office Tetsutani Bldg. 502, 2-2-2 Tokui-cho, Chuo-ku, Osaka 540-0025 Japan

Affiliate companies: SSRI China Co., Ltd. (Dalian)

SSRI Asia Pacific Co., Ltd. (Hong Kong)

HIMA Research (Shanghai)

PD Research Co., Ltd. (Japan)

URL

- July: PatientsMap 2018 CN announces the top 15 companies with high sales rep visitation rates

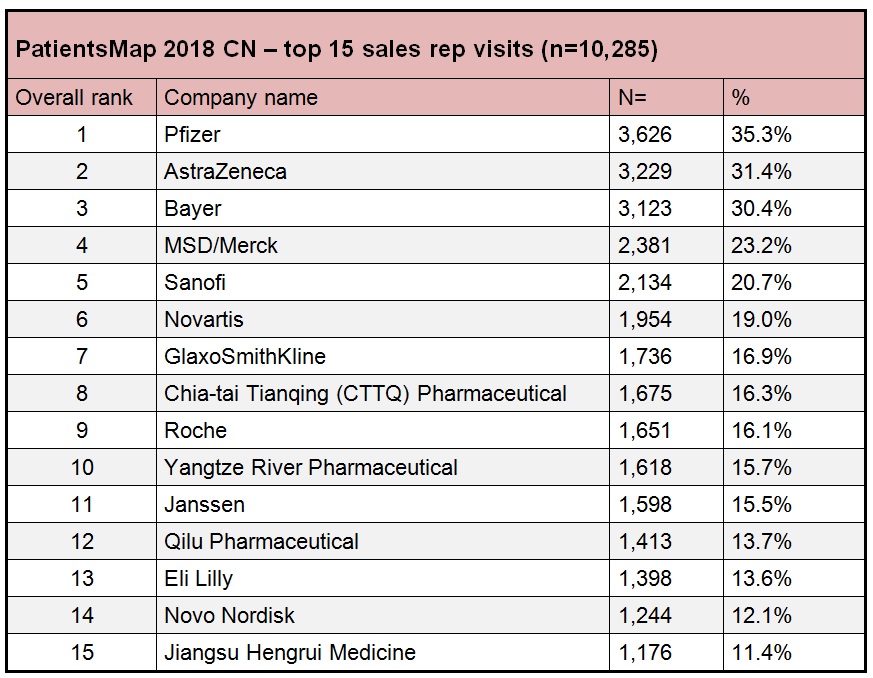

Pfizer has the highest sales rep visitation rate in China followed by AstraZeneca and Bayer:

PatientsMap 2018 CN asks doctors about sales rep visitations of 69 pharmaceutical companies in the past month. Below table shows the top 15 pharmaceutical companies with the highest sales rep visitation rates. Top 7 companies are major global pharmaceutical companies, and Chinese local companies ranked 8th, 10th, 12th and 15th. No Japanese companies ranked within the top 15th, with the highest being Eisai at 21st (8.1%).

About PatientsMap

PatientsMap is a database product which uncovers the types of diseases that various specialists see, and the monthly patient volume for each disease. The data is collected from over 36,000 physicians (from Japan, USA, UK and China) covering approximately 400 diseases/conditions. PatientsMap data collection is conducted via online in collaboration with M3.

PatientsMap can also be used as a tool for estimating nationwide patient numbers for various diseases across, not only different specialties, but also by hospital size and regions. It can help you in analyzing the potential of a new drug and also for targeting the appropriate specialties in terms of market research and/or for promotional purposes.

PatientsMap China data is collected from over 10,000 physicians, covering approximately 350 diseases/conditions. (See details below)

- June: Launch of PatientsMap China!!

On June 4th, 2018, SSRI and M3 launched PatientsMap 2018 China

Introduction to PatientsMap:

PatientsMap is a database product which uncovers the types of diseases that various specialists see, and the monthly patient volume for each disease. The data is collected from over 36,000 physicians (from Japan, USA, UK and China) covering approximately 400 diseases/conditions. PatientsMap data collection is conducted via online in collaboration with M3.

PatientsMap can also be used as a tool for estimating nationwide patient numbers for various diseases across, not only different specialties, but also by hospital size and regions. It can help you in analyzing the potential of a new drug and also for targeting the appropriate specialties in terms of market research and/or for promotional purposes.

PatientsMap China data is collected from over 10,000 physicians, covering approximately 350 diseases/conditions.

Outline of PatientsMap 2018 China:

- Product name: PatientsMap 2018 China

- Objective: To understand the treatment condition of various specialties for 357 diseases/conditions

- Methodology: Online survey

- Survey region: Nationwide

- Sample size: 10,285 physicians from various departments

- Fieldwork period: 2018 January 3rd – March 6th

Contents of PatientsMap:

- > Total number of patients that they see (per month)

- - Diseases/conditions that they see (357 disease types)

- - Number of patients they see per each disease/condition

- - Number of patients in which they prescribe medications for that disease/condition

- > Diseases in which they wish for new product development

- > Sales rep visitations in the past month (69 manufacturers)

- > Demographics

- - Primary specialty

- - Area of specialty/sub-specialties

- - Region of hospital

- - Hospital type

- - Number of beds at the hospital

- - Title

- - Age range

For more information on PatientsMap, please contact; patientsmap@ssri.com

Press release in English (PDF file): PatientsMap 2018 China - press release 0531 (ENG)

- May: Intellus Worldwide Summit 2018

SSRI and SSRI CHINA staffs attended the Intellus Worldwide Summit in Philadelphia. This was the first annual conference for Intellus after PBIRG and PMRG became one.

- February: West to East

On January 29th, our headquarters in Japan moved from the west side of Shinjuku to the east side of Shinjuku.

Their new address is:

SSRI

NMF Shinjuku East Bldg. 2F, 10-5 Tomihisacho, Shinjuku-ku, Tokyo 162-0067 JAPAN

TEL 81-3-6709-9575 / FAX 81-3-5361-7051